For decades, Ukraine’s mining and metals sector has remained a core part of the national economy. Its contribution has fluctuated under the influence of market cycles and external shocks, yet it has consistently remained significant. Today, the industry is facing the most severe challenges in its history. In the coming years, the country’s economic resilience will depend on its ability to withstand these pressures and adapt. This article was published in the NV special issue “The World Ahead”, produced in partnership with The Economist.

Economic Contribution Before the War

In 2021, the metallurgical sector generated 10.3% of Ukraine’s GDP. This estimate includes not only output produced directly by mining and metallurgical enterprises, but also services and products provided by related industries, contractors who work for the sector, as well as household spending by people employed by mining and metals companies. In other words, the metallurgical sector makes a broad-based and multi-dimensional contribution to Ukraine’s economy.

In 2021, the mining and metals sector accounted for almost 33% of Ukraine’s goods exports, generating US$22.2 billion in foreign-currency revenues. These inflows supported Ukraine’s balance of payments, helped to replenish budgets at all levels and contributed to the country’s overall financial stability. According to estimates by the Mining and Metals Centre, metallurgical enterprises paid around US$3.5 billion in taxes and fees in 2021, enabling public authorities to carry out their functions.

In effect, metallurgy is not a stand-alone industry but an entire ecosystem of economic activity. Steel underpins mechanical engineering, construction, the energy sector and the defence industry. According to our estimates, before the war, each metallurgical worker supported employment for a further four people in other sectors. In practical terms, every thirteenth employee in Ukraine was linked to the metallurgy industry.

Metallurgical plants formed the economic core of major industrial centres such as Zaporizhzhia, Dnipro, Kryvyi Rih and Mariupol. Each enterprise provided thousands of direct jobs. Before the war, Azovstal employed 10,700 people, Ilyich Steel employed 14,000 and ArcelorMittal Kryvyi Rih employed 19,500. In several regions – Donetsk, Dnipropetrovsk, Zaporizhzhia and Poltava – the metallurgical industry effectively formed entire cities whose local economies (including the services sector) were heavily dependent on its operations.

Consequences of the War

As a result of the war, Ukraine’s economy has suffered substantial losses and long-established economic links have been disrupted. Azovstal and Ilyich Steel, which together accounted for 40% of the country’s steel production, are located in occupied Mariupol. As a consequence, Ukraine has lost 40% of its pig iron exports, 30% of hot-rolled coil exports and 30% of cold-rolled coil exports.

Overall, by the end of 2024, the metallurgical sector’s contribution to Ukraine’s economy had declined to 7.2% of GDP. Export revenues from mining and metallurgical products amounted to US$6.4 billion, equivalent to 15.4% of Ukraine’s total goods exports. Last year, mining and metals enterprises paid around US$1 billion in taxes and fees to budgets at various levels.

Despite the war, metallurgists continue to invest. Last year, mining and metallurgical enterprises invested US$650 million, accounting for 18.3% of the country’s total capital investment in industry. Capital expenditure even increased by 8.3% compared with 2023. These investments included both maintenance and repair work under existing programmes – which represent a significant economic contribution amid a prolonged military conflict – and development projects. For example, in 2025, Metinvest’s assets invested actively to strengthen their energy independence, including gas-fired power plants that help to keep operations running during blackouts.

Industry in general, and metallurgy in particular, are the sectors that currently underpin Ukraine’s export-oriented economy. Agriculture is, of course, also a major exporter; however, unlike industry, it has a shorter value-creation chain. Industrial production requires many more processing stages, which in turn involves a far greater number of enterprises and people. Moreover, industry provides a more stable and predictable flow of foreign-currency revenues, as it is not dependent on crop yields or weather conditions.

The Future of Ukrainian Metallurgy

Metallurgy provides the material foundation for the country’s future post-war recovery, including the reconstruction of bridges, roads, energy facilities, housing and industrial sites. The use of modular construction technologies based on steel structures will make it possible to deliver projects at pace. For example, a single-storey building can be constructed in two months, while an eight-storey building can be completed in nine months.

The Steel Dream reconstruction concept that Metinvest has developed supports Ukraine’s recovery by offering ready-made solutions for the rapid, high-quality construction of housing, as well as social and commercial infrastructure. More than 200 standardised designs have already been developed, each based on prefabricated elements – including structural frames, modules and platforms – allowing buildings to be adapted and modified to meet specific needs.

Steel is also fundamental to strengthening Ukraine’s defence capabilities. Metinvest is already using its steel to manufacture fortified bunkers and shelters, fully-fledged underground hospitals, ballistic plates for body armour, mine-clearing trawls, protective screens for armoured vehicles and other defence-related equipment. In the long term, the extensive use of steel in the defence industry will become a key component in safeguarding national security.

Moreover, the development of Ukraine’s mining and metals sector is a prerequisite for strengthening cooperation with the EU. European steelmakers are pursuing the decarbonisation of production through the adoption of technologies aimed at reducing CO2 emissions. Ukraine’s mining and metals industry can supply the raw materials needed to produce hot briquetted iron (HBI), which is used in new green steelmaking technologies.

Outlook for 2026

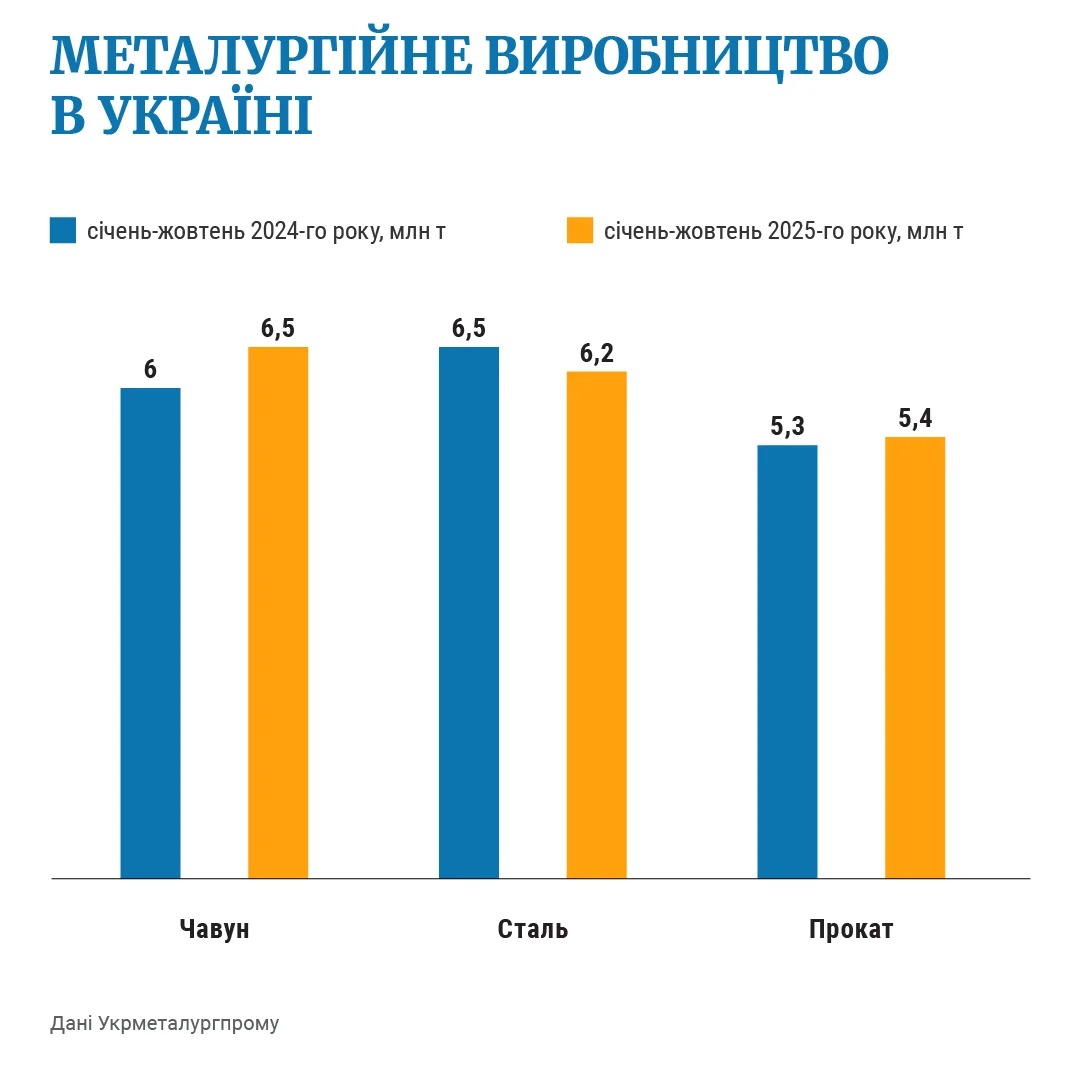

In the first ten months of 2025, Ukrainian metallurgy produced 6.2 million tonnes of steel. According to forecasts by the Mining and Metals Centre, Ukraine could produce 6.7-7.0 million tonnes of steel in 2026. Around 55% of Ukraine’s steel output is exported, as the domestic market has limited growth potential during the war. At the same time, excess steel production in China has led to increased exports from that country, resulting in lower global prices and a narrowing of potential export destinations for Ukrainian steel.

The EU remains the principal export market for Ukrainian metallurgy, accounting for around 64% of exports by enterprises in the sector. However, from the beginning of next year, the EU will introduce an additional barrier to steel imports: the Carbon Border Adjustment Mechanism (CBAM). Ukraine may be eligible for a temporary deferral in the application of this mechanism; however, no such decision has been taken to date.

The main domestic factor constraining any increase in output is the instability of electricity supply caused by Russian attacks on Ukraine’s energy infrastructure, as well as the high cost of power. In addition, persistent wartime risks related to security, labour shortages, the need to import coking coal and tariffs charged by state-owned monopolies for rail logistics continue to weigh on the sector. Taken together, these factors undermine Ukrainian enterprises’ competitiveness. While significant uncertainty lies ahead, the pace and scale of Ukraine’s future economic development will largely depend on how the country’s metallurgical sector responds to the current challenges.